Pre-sale Planning, Selling a Business, Family Business, Buying a Business

Answers to Questions from Middle Market C-Suite Executives: Part 2

This week Mirus partner Andrew Crain is answering questions from C-suite executives of middle market companies about investment bankers’ role advising private business owners. Here is Part Two of the Q&A:

Question: What are the biggest mistakes a middle market company makes in engaging in its first acquistion?

Underestimating the importance of company culture is the biggest mistake I’ve seen first-time (and even long-time) acquirers make. An acquisition can make perfect sense from both a strategic and a financial viewpoint, but all the work involved in negotiating, diligencing and closing an acquisition can be for naught if the buyer does not consider cultural fit and does not plan ahead for post-closing integration.

I recently attended a panel event at which three CEOs spoke about their acquisition experiences. Culture was the #1 issue for all three, and the issue arose in varied ways for each of them.

For one New England company, their first acquisition was located in Minnesota. They planned ahead for the logistical complexities of the geographic distance, but they did not anticipate the geographic gap in work styles. “It turns out that we just work faster on the East Coast,” said the CEO.

Another president encountered challenges integrating the acquired company’s sales force with his own. In his first deal, all but one of the acquired company’s sales staff left the company within a short time after the acquisition, because they could not / would not change their way of doing things to fit the buyer’s culture. Attuned to that issue for their second acquisition, the company focused intensely on evaluating cultural fit in advance and as a result, only one sales rep left following that second deal.

The third CEO noted that cultural integration can run in both directions, that the buyer’s ways are not always better: “You can always learn from how the acquisition target does business, and you can integrate their culture and best practices into your own in order to improve the combined company.”

Question: How have low interest rates impacted M&A? Why am I not seeing massive consolidation in areas? I would think we are in a unique time period of acquiring to grow.

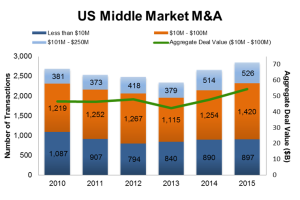

I’m a bit surprised to hear that you h aven’t seen active consolidation in the past two years. U.S. middle market M&A activity increased year-over-year in both 2014 and 2015 – especially for deals valued between $10-$100 million, where both the number of deals and the aggregate deal value reached an alltime high in 2015, as shown in this chart:

aven’t seen active consolidation in the past two years. U.S. middle market M&A activity increased year-over-year in both 2014 and 2015 – especially for deals valued between $10-$100 million, where both the number of deals and the aggregate deal value reached an alltime high in 2015, as shown in this chart:

In contrast to your question suggesting you haven’t seen consolidation through acquisition in your own sector, here at Mirus we’ve seen larger strategic acquirers stepping up to win deals in recent years as the majority of our sellside engagements in 2015 and 2014 resulted in larger competitors (both private equity-backed and publicly traded) acquiring smaller private company sellers. This occurred in a number of industry sectors – healthcare, software, food & beverage, outsourced business services, and more.

As you noted in your question, low interest rates have been a key contributor to this proliferation of M&A activity. Excess cash on corporate balance sheets, dry powder in private equity funds, and high stock prices for publicly traded acquirers all combined with low interest rates to provide an abundance of acquisition capital available to all classes of buyers, driving both deal volumes and valuations.

Middle market deal activity may be peaking, as the number of closed middle market transactions in Q1 2016 was down compared to Q1 2015. Increased volatility in the public markets is playing a role, and despite the ongoing low level of interest rates, there are rumblings that tightening credit in the middle market may begin to limit valuations if leverage ratios begin to constrict. That said, we continue to see robust deal activity with larger strategics and private equity groups eager to buy and willing to pay for quality acquisition targets, so we expect the strategic consolidation trend to continue at least through 2016.

Question: Is there preparatory work that should be in place before engaging an Investment Banker? Does being prepared materially impact the outcome of the engagement?

Preparatory work prior to engaging an investment banker is helpful, yet not essential. Being prepared DOES materially impact the outcome of an engagement so, once engaged, it is essential to work with your investment banker to prepare for the planned transaction in advance.

I find that our most successful outcomes result from maximizing competitive friction during the sale process. For most clients, this means we run a broad process to encourage as many acquirers as possible to bid on your company, and to do so at the same time. This means that multiple prospective acquirers will want to conduct preliminary due diligence, talk to you, and negotiate with us. This all needs to be happening simultaneously. Doing all of this sequentially could drag out the process and leave you disadvantaged without negotiating leverage, so it’s a huge advantage to the seller for us to manage the process in a way that gets as much done as quickly as possible.

The key to this is preparation. We’ll work with you to gather in advance a tremendous amount of detailed financial, legal and operational data. This intense preparation is an upfront time burden on company staff, but we leverage this preparatory work to benefit the process in many ways: it provides us the background material needed to present the company and the acquisition opportunity in a favorable yet realistic light when drafting a confidential information memorandum; it enables us to populate a confidential online data room in which acquirers can access additional materials that verify what’s presented in the CIM; and it provides much of the due diligence information that will be requested later by the selected acquirer’s legal and accounting teams. Most of all, by working with you to gather, prepare and distill all this information in advance, we are then in the best position to run an efficient and effective competitive transaction process to maximize shareholder value.

Recent Comments