Editorial, Mergers and Acquisitions, Selling a Business, Healthcare, Buying a Business, Strategic Advisory

A Review of 2014 Medical Device M&A

The Medical Device Industry Goes Big in 2014

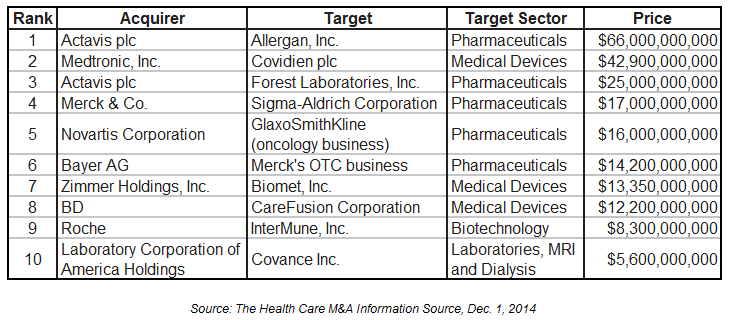

It has clearly been an exciting year in the medical device M&A space if one is stimulated by sheer deal size. Three of the top ten healthcare acquisitions of the year are medical device deals, with the Medtronic/Covidien blockbuster leading the way.

Top 10 Largest Health Care Deals,

(Through Nov. 30 2014)

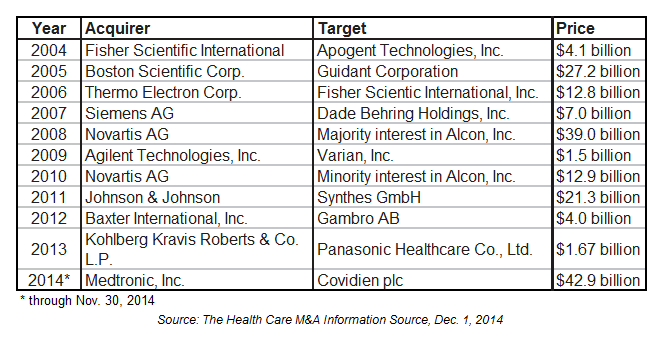

The total annual deal value is the highest in medical device history, some 17%+ over the $69 billion seen in 2008 and $72 billion higher than 2013. Clearly the belief is that bigger is better given the emergence of ACOs and the other dynamics in the market place. In fact, the year’s second largest deal (Zimmer/Biomet) would rank as the largest deal in seven of ten of the previous years.

Largest Medical Device Transactions Each Year, 2004 to 2014*

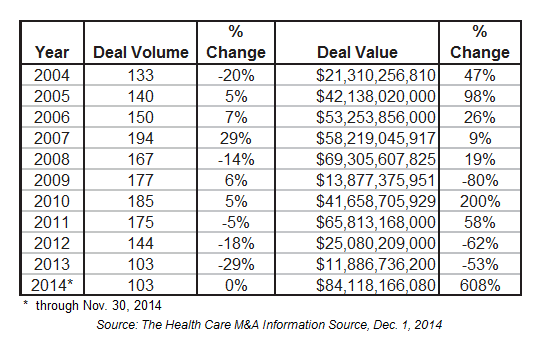

The number of acquisitions year on year, however, has remained fairly steady with 103 acquisitions through the end of November. This is equal to the 2013 total but pales in comparison to the 194 deals recorded in 2007.

Medical Device Transactions, 2004 to 2014*

Laura Dyrda over at Beckers Spine Review did an excellent job of boiling down some of the significant trends in medical device deals out of the M&A News report. In a nutshell, consolidation is having a huge impact on the device industry and orthopedics in particular. Five of her specific key takeaways are:

- Consolidation, such as the Zimmer/Biomet deal and Medtronic/Covidien deal announced earlier this year, are making even bigger global leaders.

- Mid-sized and smaller manufacturers are now merging to strengthen product pipelines.

- Tight regulations on tax inversions aren’t stopping the year’s biggest transactions in the sector, including the Medtronic/Covidien deal.

- There has been some talk of the new Republican Congress striking down the 2.3 percent medical device excise tax next year, which could make 2015 “even more interesting”.

- The last time transactions in the medical device space increased was 2010 when the number of transactions was up five percent over 2009 to 185 transactions.

What Does it All Mean?

It appears that the mega-consolidation trend will continue in the near-term at least; such as the Stryker / Smith and Nephew deal which is currently the talk of the town. These new entities will indeed be a challenge to small and mid-size companies given the selling power they wield. Practically speaking however, the mega-acquisition trend will come to an end as there are a finite number of companies of this size in the space.

It is safe to assume that these mergers will take some time to digest. Out the other end in fairly short order however should come extraordinarily large entities desperate to fuel their growth, pay the bills and meet Wall Street’s expectations. There may be some initial low hanging fruit to improve profitability by eliminating redundancies – but then what?

The challenge is that unlike pharma and biotech, there are very few if any billion-dollar blockbuster products to be had in the device area that can move a needle this big. To make matters more challenging, it is likely that these new mega-device concerns will be even less effective at organic growth than their constituent parts currently are. With the mega-acquisition targets more or less depleted, few options to move the needle remain other than looking at the middle market players as prime targets to expand market size and scope.

Based on these dynamics, mid-sized concerns should strategically position themselves to:

- Do battle with the behemoths by focusing on value add, stay true to their core competencies, explore meaningful mergers, acquisitions or joint ventures with companies of similar size and develop or acquire novel emerging technologies to further differentiate their offerings;

and

- Prospectively implement strategies to maximize the M&A process that will likely come to their doorstep.

The rising (and some would argue moving) regulatory hurdles for PMA and some 510K devices in the US, combined with the increased difficulty new ventures are facing when attempting to raise capital, would suggest that the supply of new companies with novel technologies will drop over the next several years. If this does indeed happen, given the demand dynamics above, it will accentuate what we feel is already going to be a sellers market for middle market and novel technology companies that can navigate through to commercialization. Total deal numbers may not grow much, but valuations are likely to increase – perhaps significantly.

Recent Comments