News, Surveys and Reports, Venture Capital

New England Venture Capital Activity up 23%

There were 90 venture capital fundings in New England in Q1 2010, according to the PwC/NVCA MoneyTree™ Report based on data from Thomson Reuters. That represents a 23% increase over the same quarter in 2009. The recently published report details venture capital activity nationally for Q1 2010, as well as 2009 and prior years.

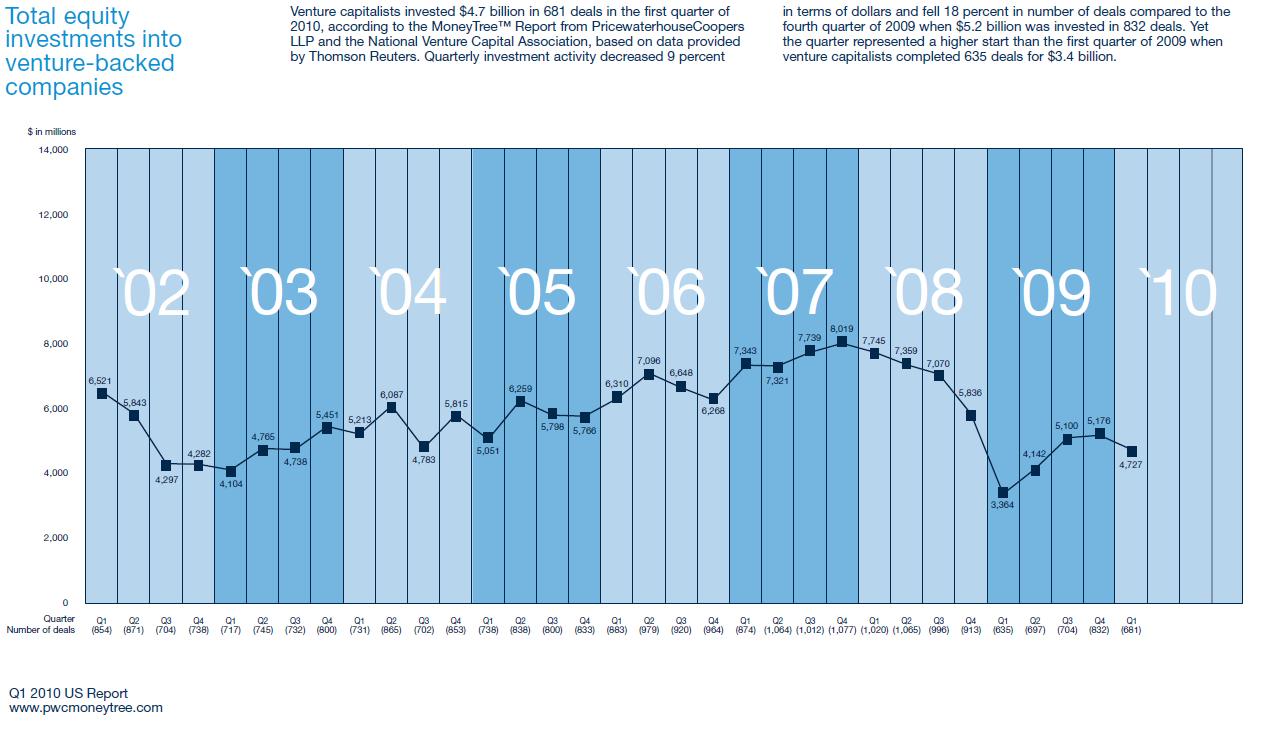

681 Deals in Q1 2010

Venture capitalists invested $4.7 billion in 681 deals in the first quarter of 2010, according to the MoneyTree™ Report from PricewaterhouseCoopers LLP (PwC) and the National Venture Capital Association (NVCA), based on data provided by Thomson Reuters. Although activity increase by 7.2% over Q1 of 2009, activity decreased from Q4 of 2010 by 9% in terms of dollars and fell 18% in number of deals.

The Life Sciences sector (biotechnology and medical device industries combined) saw a notable decrease in venture capital (VC) investing during the first quarter, dropping 26% in dollars and 21% in deals from the prior quarter to $1.3 billion going into 160 deals. Despite the drop in overall investing, investments in the Clean Technology sector rebounded, jumping 87% in terms of dollars and 44% in the number of deals from the fourth quarter of 2009.

In a press release, Mark Heesen, NVCA President said, “Despite a great deal of economic uncertainty in the first quarter, the venture capital industry moved forward with a more active start than it did in 2009, which bodes well for the remainder of the year. With health care reform passed and an improving exit market, we are expecting venture investment to increase moderately throughout the rest of 2010. However, we still anticipate investment levels to mirror that of the mid-1990’s as many venture firms will be focused on fundraising this year. Investments in clean technology and life sciences will likely drive the overall levels, but likely not far past the $20 billion mark for the year.”

Industry Analysis

The Biotechnology industry received the highest level of funding for all industries in the quarter with $825 million going into 99 deals. This level of investment represents a 24% decrease in dollars and a 14% decrease in deals compared to the fourth quarter when $1.1 billion went into 115 deals. Medical Devices and Equipment saw a 29 % decline in dollars and 30% decline in deal volume in the first quarter with $517 million going into 61 deals. This sector ranked fourth overall for the quarter in terms of dollars invested.

The Software industry had the most deals completed in Q1 with 144 rounds, although this represented a drop of 25% from the 193 rounds completed in the fourth quarter. In terms of dollars invested, the Software sector was in second place, declining 29% from the prior quarter to $681 million in the first quarter of 2010. The drop in the number of deals in the first quarter puts Software at the fewest number of deals since the fourth quarter of 1995.

The Clean Technology sector, which crosses traditional MoneyTree industries and comprises alternative energy, pollution and recycling, power supplies and conservation, saw a 87% increase in dollars over the fourth quarter to $773 million. The number of deals completed in the first quarter increased 44% to 69 deals compared with 48 deals in the fourth quarter. The increase in Clean Technology investments was driven by several large rounds, including five of the top 10 deals.

Internet-specific companies received $807 million going into 158 deals in the first quarter, a 14% decrease in dollars and a 19% decrease in deals over the fourth quarter of 2009 when $941 million went into 196 deals. ‘Internet-Specific’ is a discrete classification assigned to a company with a business model that is fundamentally dependent on the Internet, regardless of the company’s primary industry category.

Eight of the 17 MoneyTree sectors experienced dollar declines in the first quarter, including Media and Entertainment (29% decrease) and Networking and Equipment (53%). Sectors which saw increases in dollars included Semiconductors (52% increase), Industrial/Energy (12%), Telecommunications (89%), Electronics/Instrumentation (73%), Financial Services (47%), and IT Services (14%).

Stage of Development

Seed and Early stage investments declined in the first quarter, dropping 30% to $1.4 billion. The number of Seed and Early stage deals dropped 24% to 299 from the prior quarter. Seed/Early stage deals accounted for 44% of total deal volume in the first quarter, compared to the fourth quarter when it accounted for 47% of all deals. The average Seed deal in the first quarter was $5.4 million, up from $4.0 million in the fourth quarter. The average Early stage deal was $4.6 million in Q1, down from $5.6 million in the prior quarter.

Expansion stage dollars increased 9% in the first quarter, with $1.8 billion going into 224 deals. Overall, Expansion stage deals accounted for 33% of venture deals in the first quarter, up from 29% in the fourth quarter of 2009. The average Expansion stage deal was $7.8 million, up significantly from $6.6 million in the fourth quarter of 2009.

Investments in Later stage deals remained flat in dollars and fell 20% in deals to $1.5 billion going into 158 rounds. Later stage deals accounted for 23% of total deal volume in Q1, compared to 24% in Q4 2009 when $1.5 billion went into 197 deals. The average Later stage deal in the first quarter was $9.8 million, which increased significantly from $7.8 million in the prior quarter.

First-Time Financings

First-time financing (companies receiving venture capital for the first time) dollars and deals decreased 14% with $972 million going into 208 deals. First-time financings accounted for 21% of all dollars and 31% of all deals in the first quarter, compared to 22% of all dollars and 29% of all deals in the fourth quarter of 2009.

Companies in the Software, Biotechnology, and Financial Services industries received the highest level of first-time dollars. The average first-time deal in the first quarter was $4.7 million, which is unchanged from the prior quarter. Seed/Early stage companies received the bulk of first-time investments, garnering 56% of the dollars and 73% of the deals, but fell short of fourth quarter percentages when they accounted for 65% of the dollars and 77% of the deals.

MoneyTree Report results are available online at www.pwcmoneytree.com and www.nvca.org.

Recent Comments