Private Equity, General, Mirus Capital Advisors, Mergers and Acquisitions, Fund Raising, Advice for Entrepreneurs, Selling a Business, Technology, Software

Smaller Software Companies Enjoy Increased Options Based on Growing Private Equity Interest in Technology

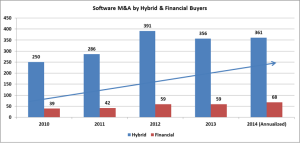

Over the last five years the technology sector has attracted an increasing number of private equity investors. More specifically, platform investments (financial) and follow-on acquisitions (hybrid) have grown 25% and 30% respectively over the last five years, based on our analysis of CAPIQ data.

When we parsed the data to identify the most active private equity investors we made three primary observations. First, we were not surprised to see long established private equity technology investors such as, Vista Equity, GTCR, TA Associates, Summit Partners, JMI Equity, Bain Capital, Northbridge, Accel-KKR, among others. Second, there are an increasing number of new software/Tech specialist investors entering the market such as Parallax Capital Partners, Stone Calibre and Toba Capital. And finally, there are several mid-sized funds such as Riverside Partners, ABRY Partners and Alta Equity Partners, traditionally focused on healthcare and Telecom/Media/Technology respectively diversify into enterprise software.

What’s interesting about this trend is that it means that even smaller software companies ($1-$5M of EBITDA) now can consider not only strategic exit options but also sponsor buy-outs and/or recapitalizations. So what explains the growing and/or renewed interest in technology and more specifically software investing? I’d offer up a couple key drivers, including:

- More Reasonable Asset Values Due to Less Competition – Less competition from large strategic enterprise software buyers ( Oracle, SAP, etc.) who are focused on SaaS software, as opposed to, traditional on-premise software companies, equating to more reasonable price assets.

- Follow the Smart Money – The success of some larger higher profile private equity investors such as Vista Equity Partners, whose complete focus on enterprise software and improving their investment’s operational efficiencies has created strong IRRs ( 30%+), which has allowed them to raise $10B+ over several funds.

- Plenty of Recurring Revenue – Companies in this sector consistently have strong recurring revenues typically tied either to maintenance or SaaS pricing models.

- Interesting Upside Opportunities –In many cases investors are attracted by upside opportunities either in the form of opening new market segments by developing a SaaS offering or by consolidating a highly fragmented software niche ( as is illustrated in the hydrid acquisition columns above).

One final observation that will support increased private equity investment in the sector is the growing number of war stories from software entrepreneurs who opted to sell to strategic buyers only to see their company’s greatest assets destroyed either due to brain drain or bureaucracy/politics. If you’re a software entrepreneur and you’re interested in learning more about partnering with private equity, I’d be happy to share my experiences.

Recent Comments