Data and Economic Statistics, Mirus Capital Advisors, News, Surveys and Reports, Editorial

New Data: The Economic Recovery is Underway

Market Overview / Month-End April 30, 2010

The U.S. economic recovery is underway with a 3.2% increase to GDP in the first quarter, according to new data today from the Commerce Department. The increase, which was in line with economists’ forecasts, marked the third straight quarter of growth following the worst recession the U.S. has faced since the Great Depression. The Federal Reserve repeated its vow this week to keep interest rates low, despite the stronger economy.

Data released Tuesday showed that home prices rose on an annual basis for the first time in more than three years in February. Consumer confidence is also on the rise, reaching an 18-month high in April. Retail sales and factory activity have improved, and hiring by U.S. employers grew in March at the fastest rate in three years. Inflation has been modest.

News that at Standard & Poor’s downgraded the debt of Spain, Portugal and Greece this week took stocks sharply lower on Tuesday and early Wednesday, but buyers later stepped back in to offer support. In turn, stocks have retraced most of the slide and currently sit near the 19-month high. News of the debt downgrades sent the dollar higher against the euro, so if you’re planning a trip to Paris this spring, you’re in luck.

On the Mend

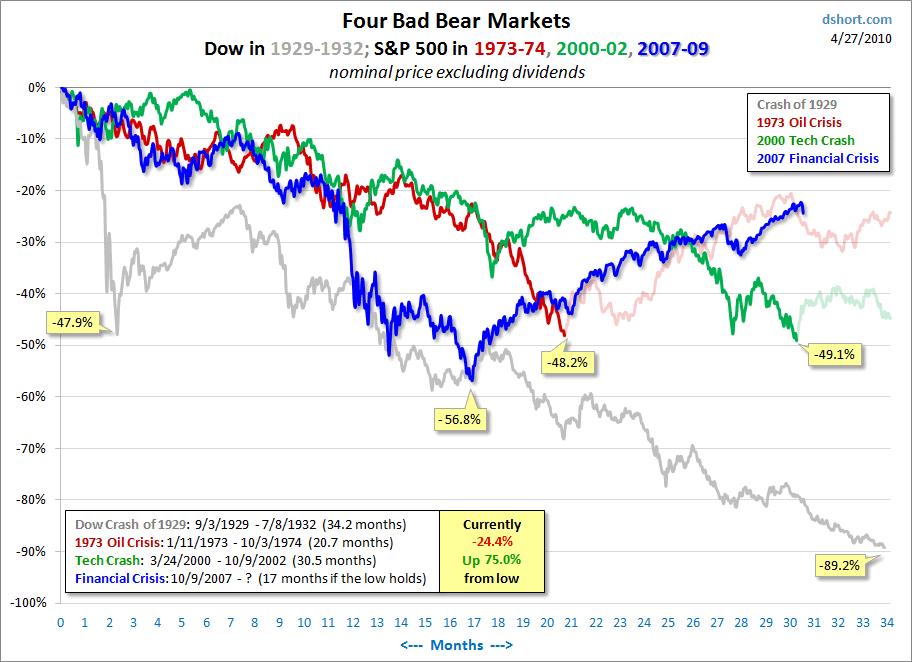

Just one year ago, investors feared that the market might be on a track that resembled the bear market of 1929-1932, but since that time the market has been on a largely uninterrupted bull run. As illustrated by the chart below, the S&P 500 is up 75% from its low in March 2009. If that low continues to hold (as most economists expect), it means that the bear market which began in October of 2007 was just 17 months in duration, comparing favorably to the 30-month slide that followed the bursting of the dot-com bubble a decade ago.

Recent Comments