Banks, Surveys and Reports, Federal Reserve

Credit Standards, Loan Covenants, and Rate Spreads Eased in Q2

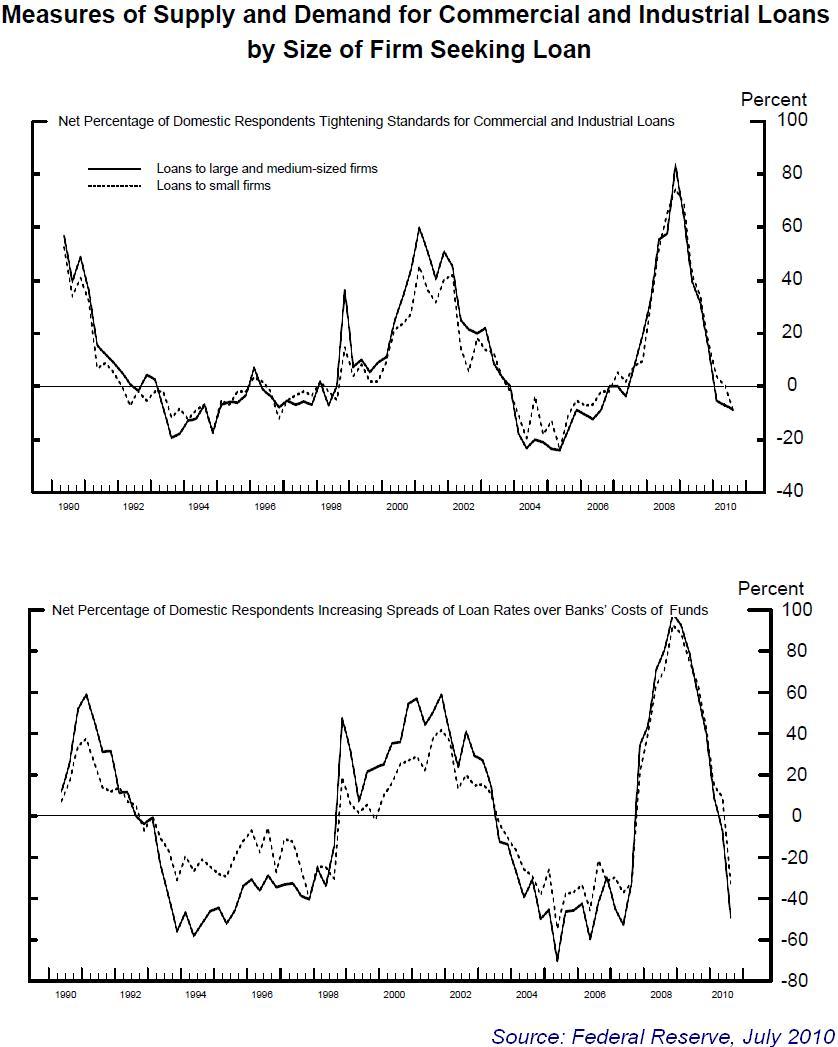

Lending conditions for commercial and industrial loans began to ease in the second quarter, according to the Federal Reserve’s survey of U.S. lenders, which was published on Monday. Of the senior loan officers surveyed, 12.5% indicated a relative easing of credit on large and middle-market borrowers (revenues in excess of $50 million), and 14.5% indicated a relative easing of credit for smaller firms, providing some hope for an economic recovery that otherwise seems to be losing momentum. Survey respondents also reported having eased covenants, rate spreads and other terms on C&I loans to firms of all sizes, continuing to unwind the widespread tightening that occurred over the past few years. This was the first time since the end of 2006 that the quarterly Senior Loan Officer Survey indicated an easing of credit standards on C&I loans to smaller firms.

Lending conditions for commercial and industrial loans began to ease in the second quarter, according to the Federal Reserve’s survey of U.S. lenders, which was published on Monday. Of the senior loan officers surveyed, 12.5% indicated a relative easing of credit on large and middle-market borrowers (revenues in excess of $50 million), and 14.5% indicated a relative easing of credit for smaller firms, providing some hope for an economic recovery that otherwise seems to be losing momentum. Survey respondents also reported having eased covenants, rate spreads and other terms on C&I loans to firms of all sizes, continuing to unwind the widespread tightening that occurred over the past few years. This was the first time since the end of 2006 that the quarterly Senior Loan Officer Survey indicated an easing of credit standards on C&I loans to smaller firms.

Banks indicated that there has been increased competition in the market for originating new C&I loans, an important factor behind the recent easing of terms and standards.

The Fed survey, asked lenders in part, “how have your bank’s credit standards for approving applications for C&I loans or credit lines (other than those to be used to finance mergers and acquisitions) to large and middle-market firms and to small firms changed?” The responses were classified into those from large banks and those from other banks. Most of the sentiment toward greater easing has come from the large banks, in part due to the fact that regional and community banks had not tightened credit to the same degree during the crisis. The report also included responses relative to demand for loans and found that demand was little changed in Q2 after falling in the first three months of the year.

Source: The Federal Reserve, July 2010 Senior Loan Officer Opinion Survey on Bank Lending Practices.

Summary of the Report

http://www.federalreserve.gov/boarddocs/snloansurvey/201008/default.htm

Full Report with Exhibits

http://www.federalreserve.gov/boarddocs/snloansurvey/201008/fullreport.pdf

Recent Comments