Mergers and Acquisitions, Mirus Capital Advisors, Consumer

Invest, Harvest, or Divest

Retailers of all stripes face a challenging environment. E-commerce is growing by 15-17% per year, while traditional catalogers and brick and mortar are down or flat. Prospecting is difficult, expensive and inconsistent. However, even e-commerce companies see mixed results as Amazon continues to expand and suck the oxygen out of the market. That is unless one is in the Amazon marketplace.

So what is the strategic direction you should take? Sell? Invest? Acquire?

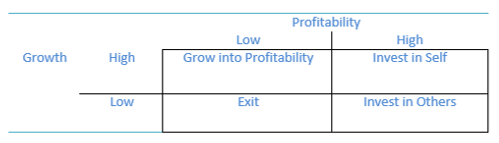

Let’s use a simple 2×2 matrix to simplify the alternatives. One axis will be growth while the other profitability.

There are four corners to a 2×2 matrix let’s explore each of them:

- Fast Growing/ High Profitability

Of course this is where everyone wants to be. A successful business in all aspects lots of growth in the topline and much of it falling to the bottom line. If this is your business, you should likely continue to invest in it. It is likely that marginal investment will be better put to work here than an alternative slower growing or less profitable business. If you do want to cash out, demand a high multiple relative to your earnings and scale.

- Slow Growing/ High Profitability

This is the classic cash cow. Take the money the business generates and invest it in faster growing, higher potential businesses, or buy a yacht. The business needs some investment to protect it from falling behind competitors and disruptors. If the industry growth is also slow, innovate and steal share. Always be on the lookout for disruptors and new business models, but keep investment low until you find where to strike. Or take the cash and bask in retirement.

- Fast Growing/ Not Highly Profitable

This is a tricky business. There is analysis that needs to be done:

- Is the low profitability due to lack of scale which will be solved by growth? This is the classic e-commerce conundrum. Amazon, Uber or Facebook all convinced their investors that they will grow into their valuations. Some have proven themselves, others not so much. Continue to invest in your business if you think the business model will prove to be profitable.

- However, if bringing the firm to profitability requires the perfect scenario, untold of transformations and other miracles, then pass off the hot potato to an investor. They may have the ability to see, invest or execute what you can’t.

- Slow Growth /Low Profitability

Dogs need to be exited. Sell the business and find a better place to invest your money. Unfortunately many legacy catalog businesses find themselves in this quadrant. Amazon and eBay have choked off the profitability with price and prospecting competition. Also, since everyone uses the same 4 or 5 cooperative databases distinguishing your business and prospecting are difficult. It’s sad, but cut your losses and cut the business loose.

Of course, each situation has its own characteristics and potential. You should understand where you fit. The tough, big decisions are easier if you step back and look at the big picture.

Recent Comments