General, Mergers and Acquisitions, Pre-sale Planning, Selling a Business, Valuation Services, Software

8 factors driving software valuation multiples

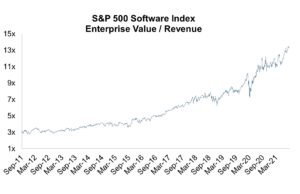

Public software company valuations have risen to astronomical levels in recent years. Valuations for small privately held software businesses are strong as well and can vary significantly from one transaction to the next.

What drives a 2x revenue multiple vs. a 10x revenue multiple? Some key factors influencing transaction multiples include:

- Size: larger companies command higher multiples.

- Revenue mix: some companies have a mix of software and services, or a mix of subscriptions and perpetual licenses. True SaaS multiples are generally only applied to the recurring software portion of revenue. Service multiples should be applied to service revenue, and lumpy one-time perpetual license revenue may generate a lower multiple then predictable recurring SaaS revenue.

- Revenue growth: fast-growing companies demonstrate the potential for future growth.

- Profitability: profitability can be a “nice to have” for some SaaS companies – acquirers will want to see a path to profitability and strong gross margins, but if the business is successfully investing its profits towards rapid growth, that situation can also be attractive to buyers.

- Customer churn: ideally churn should be less than 10%. Customer tenure and stickiness are key to achieving a higher valuation.

- Customer diversification: there’s generally less risk with a large, diversified customer base than with a few core accounts.

- Competitive differentiation: anything that makes it difficult to replicate the business model makes a company more attractive, whether that’s a complex algorithm, patent protection, or unique knowledge of a particular sector or process. Being the established market leader in your niche also suggests a higher valuation.

- Addressable market size and growth: a software business in a sector where every company is already using a similar product (i.e. manufacturing ERP software) has to win almost every new account from an incumbent vendor. Software products in less saturated markets may have greater growth potential.

While multiples vary by sector and by company, we are seeing strong interest in every software company we’ve worked with recently.

For further input on what kind of multiple your software business might achieve, please reach out at soto@merger.com to discuss your unique situation.

Recent Comments