Mergers and Acquisitions, Venture Capital, Angel Investors, Healthcare, Raising Capital, Strategic Advisory

Mind the Funding Gap

THE SERIES A CRUNCH

I recently published a whitepaper on the challenges that early stage therapeutic device companies are having raising money, along with what I hope is some meaningful advice on alternative funding options. The gist of the article is that friends and family money is still fairly easy to come by. Initial seed round funding from angels ($300-500k) is available and in some cases angel groups are syndicating deals and raising up to $2M.

It is the next step, typically called the “A-round”, where VC money comes into play where companies are hitting a wall. I ascribed a portion of this to the fact that therapeutic devices have many of the challenges (regulatory and reimbursement primarily) that biotech and pharma have, without the same potential return so VC’s were backing away.

There is another dynamic that I left unexplored in this paper however having to do with raise size. One might assume that a smaller amount would be easier to raise. It has been my experience in fact that A rounds of $2 – 5 million are the hardest to get any interest in. I call them ‘tweeners or in the gap. It would appear that “we’re just looking for $3M” is something of a curse.

Apparently this phenomenon is not isolated to the med-tech space, but is a broader challenge. A recent article by Seth Oranburg very eloquently details the challenges facing all start-up’s looking for series A funding. According to his article, the average VC investment has increased consistently from $1.7 million in 1985 to $4.9 million in 2013. Data from the National Venture Capital Association, Yearbook 2014, suggests that VC’s prefer to invest larger amounts in fact with the average A-round coming in north of $7M.

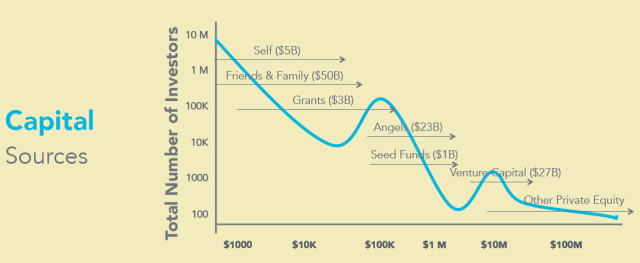

This graphic from Seth’s article perfectly illustrates this gap – or if you are the one looking for the funding – the A-round abyss.

As challenging as this might be, we believe there are some clever ways to bridge this gap and encourage you to check them out here, but proactive planning and good counsel are key any way you slice it.

You can find more of Patrick’s insights and experiences here or contact him at west@merger.com.

Recent Comments