Data and Economic Statistics, General, Advice for Entrepreneurs, Consumer

COVID-19 Impact on E-Commerce

Approximately 51% of United States residents are at least partially vaccinated as of June 2021. With the rate of positive COVID-19 cases dipping, we are slowly watching the country return to pre-pandemic life. As we watch life return to normal, it is clear that there will be potent effects to both retail and e-commerce in the coming months.

According to McKinsey & Co., more than 50% of US consumers plan to splurge in the coming months, especially higher-income millennials. In fact, according to CreditCards.com, 44% of consumers are prepared to take on debt in the next few months to splurge on various goods. Individuals plan to spend on apparel, beauty, and electronics. Those who do not plan to spend are waiting for the pandemic to settle further before splurging for restaurants or travel. One shift that has resulted from the pandemic is house-related spending. -28% of all consumers have renovated their living situation in some manner. About 30% of consumers plan to purchase items to furnish their home post-pandemic.

However, looking forward, some economists are skeptical that the market will initially return to what it was. According to KPMG, some consumers will choose to remain at home regardless of being vaccinated. The report states that this was seen in Denmark, South Korea, and China, – all countries that have flattened the infection curve. With retail businesses, COVID-19 has likely changed the behavior of the average consumer for the long term. For example, about 50% of those who currently engage in roadside pick-up at restaurants plan to continue the behavior. In fact, according to Matt Marcotte, Senior Vice President at Salesforce, while physical shopping experiences will become prevalent again, e-commerce will remain the priority. He stated that COVID-19 has left the American population starved for physical, real-life experiences, and many will return to shopping in person again. However, e-commerce has proved itself to be both efficient and reliable, and it does not seem to be slowing down any time soon.

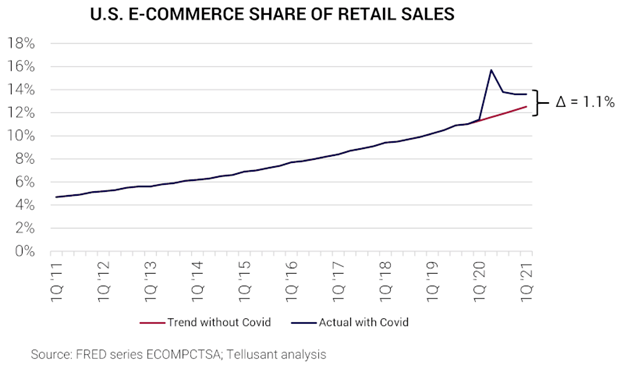

COVID-19 undeniably changed e-commerce. With the fear of being exposed to the virus at physical shopping centers, many customers took to online retail. Prior to COVID-19. E-Commerce made up 11% of all retail. As of February of 2021. E-Commerce rose to nearly 16% of all retail in April of 2020. It has settled down to about 14% in 2021. Tellusant estimates that e-commerce is now about 110 basis points ahead of where it would be had there not been an acceleration due to the pandemic.

Throughout the pandemic, the e-commerce industry has instituted a series of changes that will allow it to hold its ground as COVID-19 becomes an event of the past. Previously, one of the largest issues with e-commerce was you could not actually see the product first-hand. However, many stores have utilized augmented reality (AR) to allow for a real-life shopping experience while shopping virtually. This allows for the more personal feel for shopping that in-person retail previously provided for. It is estimated that COVID-19 has furthered the AR movement and it will likely continue post-pandemic. By the end of 2021. AR is projected to be a $26.75 billion market, which is at an estimated 5.14% increase from 2020.

Furthermore, many consumers plan to hold on to the buy online, pick up in store (BOPIS) model that has emerged during COVID-19. Prior to the pandemic, in 2019, BOPIS was 5.8% of total e-commerce. By the end of 2020, BOPIS totaled to be 9.1% of all e-commerce. The market is forecasted to grow, and it is expected to be about 9.9% of total e-commerce by the end of 2021. According to the report, about 56% of consumers plan to continue using the BOPIS model after the pandemic.

During the pandemic, many consumers began to rely on same-day shipping at stores they no longer felt comfortable physically going to. For both store-based retailers and web-only merchants, many shoppers opted for the same-day delivery option. Initially, the model required some tweaking, as consumers would select the same-day option and the likelihood of same-day arrival was variable. However, after over a year in the pandemic, many stores have fully adapted and are now able to deliver same-day shipping. Companies like Instacart and DoorDash rose to prominence due to the same-day shipping model, and they, too, are here to stay. According to a 360 Commerce Study from February of 2021. 68% of consumers will place on online order if they are promised fast shipping. 36% of online shoppers have made purchases with same-day delivery. With e-commerce’s rise to prominence during the pandemic, features like same-day shipping will – and must – stay to retain the consumers that switched over during the last year.

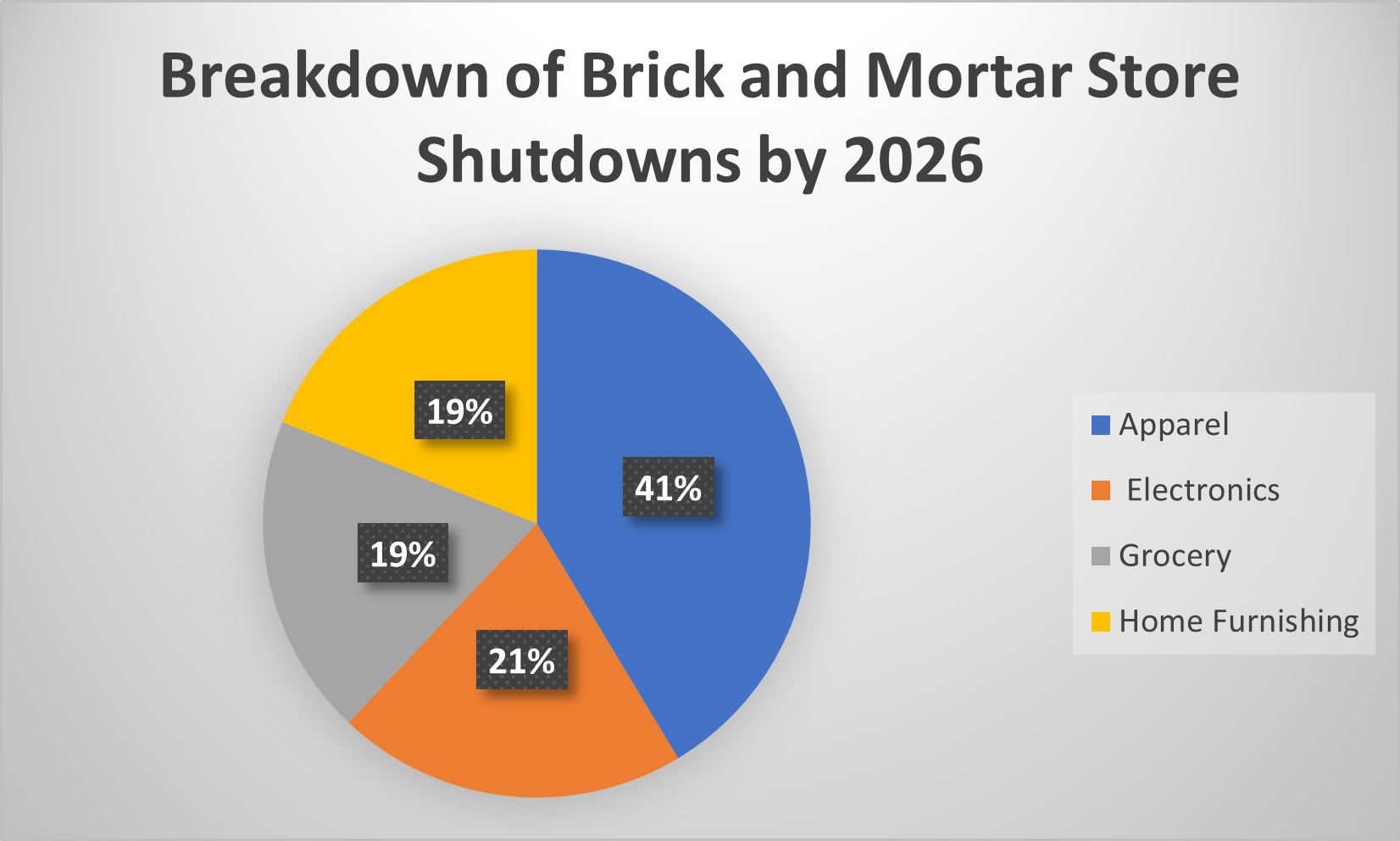

The growth of e-commerce will likely continue to affect brick-and-mortar stores. As many as 100,000 stores are likely to close in the coming 5 years. It is currently estimated that apparel retailers will be the most affected at about 24,000 closures, followed by 12,000 consumer electronic stores and 11,000 grocery stores and home furnishing stores. However, brick-and-mortar stores have done well for themselves over the past few weeks, so it is difficult to gauge what the future holds. According to an article published by the US Census Bureau, recent easing of lockdown rules might work to the benefit of these stores that were hit the hardest during the pandemic. Regardless of the diminishing prominence of brick-and-mortar stores, it is clear that the United States economy is recovering. According to a report by the United States Department of Commerce, real GDP increased at an annual rate of 6.4% in the first quarter of 2021. This growth the reopening of businesses and a new influx of customers who feel safer to shop due to the vaccination rate.

Overall, it is clear that COVID-19 accelerated the trends of both retail and e-commerce. E-commerce has made itself integral to the way we shop, and it is unlikely its growth will decelerate any time soon. Despite the growth of e-commerce, as the United States reaches the final stages of this pandemic, it is clear that in-person retail will still hold a place in the heart of consumers. Overall, by the end of 2021, retail is expected to grow by 7.2% Many plan to splurge and spend in industries that were neglected during the pandemic, and we can slowly see the American economy heading back to normal.

———————————————-

https://www.cnbc.com/2021/06/02/covid-19-cases-deaths-and-vaccinations-daily-us-data-on-june-2.html

https://www.bea.gov/news/glance

https://advisory.kpmg.us/content/dam/advisory/en/pdfs/2020/retail-after-covid-19.pdf

https://www.digitalcommerce360.com/2021/03/16/online-shoppers-demand-same-day-delivery/

https://www.statista.com/chart/14011/e-commerce-share-of-total-retail-sales/

https://www.businessinsider.com/click-and-collect-industry-trends

Recent Comments