General, Data and Economic Statistics, Mergers and Acquisitions, Mirus Capital Advisors

E-Commerce Valuation and the COVID-19 Bump

COVID-19 is the story of the year 2020. It had a profound effect on our businesses, politics, health and relationships. Analyzing the effects on relationships, politics and health should be left to doctors, therapists and pundits. How it affected business, especially e-commerce, is fascinating.

While much of the country was shut down beginning in mid-March – including most of retail – much of e-commerce thrived. Buying remotely became the only way to buy many categories. Amazon, FedEx and UPS could hardly keep up. Second quarter 2020 saw a 31.9% increase in e-commerce sales from first quarter 2020.

According to the U.S. Census Bureau, e-commerce as a percent of retail sales rose from 11.8% in the first quarter 2020 to 16.1% in the second quarter. There is a lot of noise in those numbers….long term trend towards e-commerce, short term declining retail sales, two weeks of lock down in first quarter. Comparing third quarter 2019 to third quarter 2020 will give a clearer picture. Here we see an increase in e-commerce as a percent of retail sales from 11.2% to 14.3% – an acceleration from the long-term trend.

But the real question clients and prospects want the answer to is whether the COVID Bump has affected valuations. Will buyers discount valuations presuming that earnings will return to pre-COVID levels. Retailers of all stripes are looking at the COVID Bump – an acceleration of the trends that were already happening. With the continued strong sales trends in e-commerce and catalog generally, the current view among consumer industry executives– including the CEOs of Wayfair, Macy’s and 1-800 Flowers – is that ongoing shifts in consumer purchasing trends have accelerated and compressed several years of change into 2020. We have reached a new normal.

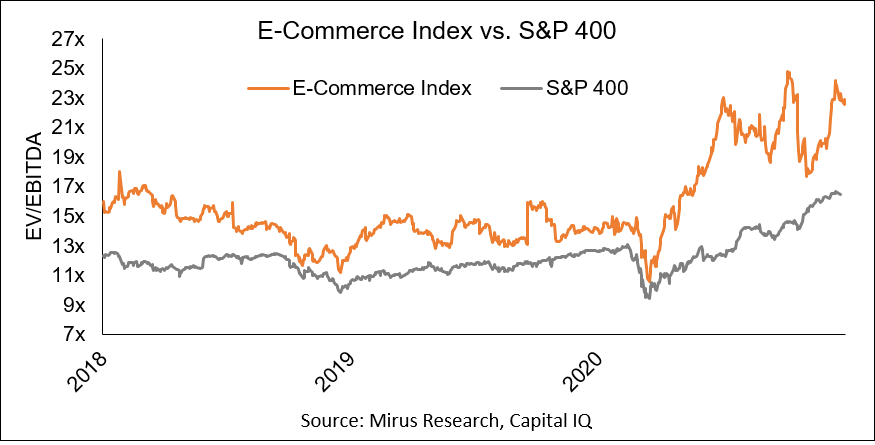

The shift towards e-commerce and increased earnings have increased e-commerce valuations in public market, but, surprisingly, not that much more than the market as a whole. The charts below show an index of the valuations of public e-commerce companies compared to the S&P 400. (midmarket companies) You can see that e-commerce companies trade at lofty valuations (thank you Amazon), but the surge in valuation this year merely mimics the overall rise in the market after a summer bump.

The table below highlights the year ending valuations:

Valuation multiple for e-commerce companies have increased 63% in a year, but the market as a whole increased (only) 30%. A strong COVID Bump increased the e-commerce premium by over three times last year’s premium and more than twice what it was two years ago. Given the strong dynamics in favor of e-commerce– and the view towards the future – it has been a nice time to own an e-commerce company, despite – or because of – the raging pandemic.

The e-commerce index includes: 1-800-FLOWERS.COM, Inc. (NasdaqGS:FLWS), eBay Inc. (NasdaqGS:EBAY), Etsy, Inc. (NasdaqGS:ETSY), Peloton Interactive, Inc. (NasdaqGS:PTON), Revolve Group, Inc. (NYSE:RVLV).

Recent Comments