General, Advice for Entrepreneurs, Mergers and Acquisitions, Mirus Capital Advisors

Every Owner Exits

There comes a time in every business owner’s life when he or she will move on. Exiting an ownership position can take many forms, from a very public IPO, to a gift to the heirs, a sale to new owners, to, I dare say, a tragic death at the desk.

This article highlights the characteristics of the less tragic and more common methods of monetizing the transfer of business ownership. There are two broad categories this article will address:

1. An Initial Public Offering (IPO)

An IPO is a process by which shares in a company are sold to the public. It generally concludes with the shares traded on an exchange, such as NASDAQ or the NYSE. A highly regulated process, an IPO is typically used for large businesses, as expenses, both for the process and the ongoing compliance term, are high. The advantages include on-going liquidity of the shares, typically at higher valuations than privately held companies. Also, public companies are a method of a potential evergreen life for an independent business.

There are 3 flavors of IPOs:

- Traditional: the company hires an investment bank to underwrite the process and find buyers of the stock. Proceeds can be used to pay current shareholders or invest growth capital.

- Direct Listing: the company sells existing shares of the company by itself without investment bankers.

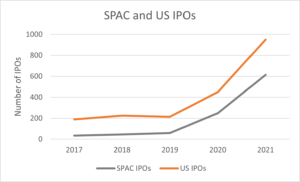

- Special Purpose Acquisition Company (SPAC): a SPAC is an empty public shell – or blank check company – which has money but no business. The SPAC buys the company. Extremely popular the last 12 months, this seems to be a fad which comes and goes. In 2021, SPACs had raised capital in 613 IPOs a record.

IPOs ebb and flow based on market conditions. 2020 IPOs saw a record number. That number was crushed by the record number in 2021. The graph below highlights the trend over the past several years:

Sources: Mirus Research, Capital IQ, Statista

2. Sale of Business

Then there is the sale of a business. Here, too, we see 2 major flavors:

- Sale to another entity

- Strategic Entity – another company

- Private Equity Group (PEG) – an investment company

- Hybrid Entity

- Sale to an Employee Stock Ownership Program (ESOP)

The sale of a business to a Strategic Entity, PEG, or to a strategic entity owned by a PEG (Hybrid) generally follows the same process. Private equity funds invest across a range of industries. In 2020, the US private equity sector included approximately 4,500 private equity firms and 16,000 PE-backed companies (Hybrids).

There are several commonalities whether an investment bank manages the process (highly recommended), or the owner goes it alone. The process has 5 key stages:

- Prepare and develop marketing materials

- Research and outreach to potential acquiring entities

- Diligence of the selling entity by the potential acquirer

- Negotiation of definitive documents

- Closing

All together, a traditional sale process for a business takes between 4 months and a year. A typical well-run investment-banker-managed process will take between 6 and 9 months.

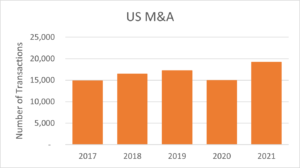

2021 was another strong year for M&A with more than 19,000 transactions closed in the US, the highest levels seen in recent years and up 29% over 2020 totals.

Sources: Mirus Research, Capital IQ, Statista

Finally, there are ESOPs. An ESOP is a tax-advantaged retirement vehicle for business owners who sell the company in whole or in part to the employees. Also regulated, the sale is usually financed by debt, and often takes place over multiple years. Mostly unknown until 1974, ESOPs are now widespread; as of the most recent data, 6,460 plans exist, covering 14.2 million people.

This article highlights some of the characteristics and points out a few of the more common methods of monetizing an exit of the business. At a future date I will write about the pros and cons of the various exit strategies.

Whether one sells a business, liquidates it, or gifts it to an owner’s heirs at some time, every business owner must face an exit.

Recent Comments