Mergers and Acquisitions, Selling a Business, Family Business, Strategic Advisory

The Return of Public Acquirers to the Middle Market

Mirus Capital Advisors has been in business for over 25 years, working with businesses with a variety of ownership structures – public, family-owned, private equity owned, venture-backed, entrepreneur owned, etc. and we’ve been fortunate to work with a lot of closely-held businesses in sales to public companies. Since we’re based just outside of Boston, we work with a lot of companies in the eastern New England area.

In the past four months, we’ve sold four closely-held businesses in Massachusetts and New Hampshire to four public companies.

The drivers for these deals varied – the owners’ goals ranged from retirement to liquidity & growth. And the interest from bidders ranged from intense to modest. But in the end they each sold to a public acquirer rather than to another private company or private equity fund (or ESOPs etc).

Four deals don’t make a trend, and the interest from public companies in acquiring growth and putting relatively low-cost capital to work should be obvious to most deal professionals – and perhaps business owners, but it did raise the question – are sales to public companies on the rise?

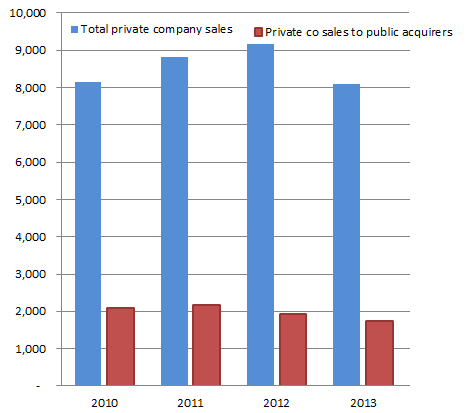

M&A and private equity activity was generally slow in 2013. As noted by Pitchbook[1], private equity deal flow fell 14% in 2013 to 2,124 transactions, with the amount of capital put to work increasing only because of the “flurry of deals with a price tag of $2.5 billion or more.” M&A was down in 2013. Private company transaction volume (US and Canada, excluding financials and utilities) was off 12% from 2012.

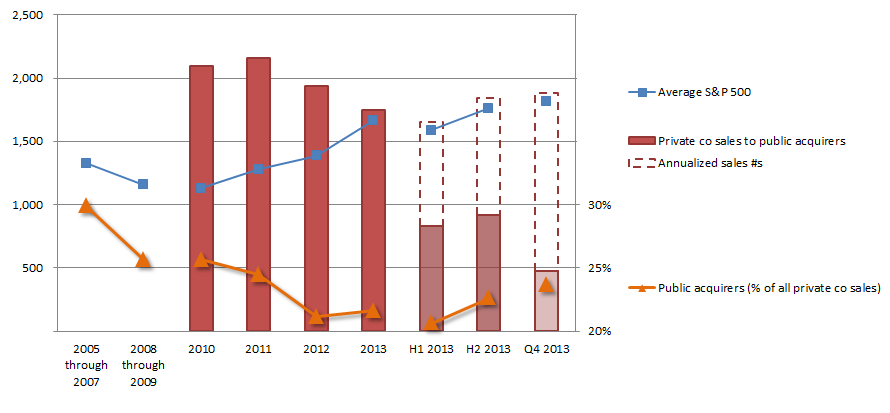

We looked back at how the mix of sales of private companies to public companies vs. other private companies or private equity has changed in recent years and the results were somewhat surprising. For the years leading up to the recent recession, public companies represented 30% of the buyers for non-financial, non-utility private sellers. Of the 27,000 private companies sold from 2005 through 2007, over 8,000 went to public acquirers.

This percentage dropped, as one might suspect, during 2008 and 2009. What’s interesting is that the percentage did not come back up again from 2010 through 2013, a period when the S&P 500 went from 1115 to 1848 – an increase of over 60%. During that time the number of private to public sales declined from 2,093 to 1,748 while the overall number of private sales went from just over 8,000 to over 9,000 in 2012, before dipping back to 8,000 in 2013.

In fact it’s only been during the last few months of 2013 that we’ve seen percentages of public buyers reach 23% after dipping to 21% in 2012.

- Return of public acquirers of private companies

In 2010 for example, when the S&P 500 averaged under 1140, public acquirers bought 26% of the 8,100 private companies sold that year.

Over the next few years, the S&P 500 moved to over 1800 while the percent of private companies going to public acquirers declined to under 22%. In the second half of 2013, the data starts to show that percentage moving up – by Q4 2013 it stood at almost 24% on a promising run rate of deal activity.

So, is Mirus’ recent experience a bellwether and will public acquirers again win 30% of private company sell-side deals in 2014 or will the mix of low-cost debt and abundance of private equity favor private buyers?

[1] PITCHBOOK. PE BREAKDOWN 2014 ANNUAL REPORT

Recent Comments