Mirus Capital Advisors, Mergers and Acquisitions, General

Every Owner Exits – Part II

As a follow-up to last month’s blog, I’d like to share some additional thoughts on exit options. Below I discuss the options of going public or selling a business.

Go Public

- When a firm decides to go public, there are three primary options

- Traditional IPO – the company hires an investment bank to underwrite the offering and facilitate the process. The investment bank charges a commission for its work. Offerings can be either fixed price or book building.

- Under a fixed price offering, the company going public determines a fixed price at which its shares are offered to investors. The investors know the share price before the company goes public. Demand from the markets is only known once the issue is closed.

- Under a book building offering, the company going public offers a 20% price band on shares to investors. Investors then bid on the shares before the final price is settled once the bidding has closed. Investors must specify the number of shares they want to buy and how much they are willing to pay. Unlike a fixed price offering, there is no fixed price per share. The final share price is determined using investor bids.

- Direct Listing – the company does not hire an underwriter and sells only existing, outstanding shares. This eliminates underwriting fees, does not create share dilution and avoids lockup periods, but provides no safety net ensuring that the shares sell.

- Special Purpose Acquisition Company (SPAC) – a SPAC is a company that has no commercial operations and is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring or merging with an existing company. At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisition. SPACs have two years to complete an acquisition or they must return their funds to investors. SPAC’s seem to be waning fad.

- Traditional IPO – the company hires an investment bank to underwrite the offering and facilitate the process. The investment bank charges a commission for its work. Offerings can be either fixed price or book building.

Sale of Business

- When a company decides to sell its business, it hires an investment banker to facilitate the process.

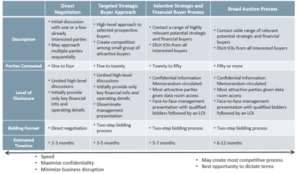

- The investment bank and company determine the client’s transaction objectives and what type of process to run (see following slide).

- The investment bank drafts offering materials, conducts outreach, negotiates offers and leads the due diligence process on the company’s behalf.

- Buyers fall into three categories:

- Strategic buyers are acquirers that operate in the same or similar industry as the company being sold.

- Financial buyers include private equity groups, family offices, and other financial investors who are looking to acquire the company as an investment.

- Hybrid buyers are acquirers who operate in the same industry and who are currently backed by a private equity firm.

Stay tuned next month for Part III, where I discuss recapitalizations and ESOPs.

ABOUT MIRUS CAPITAL ADVISORS

Founded in 1987, Mirus Capital Advisors is a middle-market investment bank that specializes in merger advisory, capital-raising services, fairness opinions and valuations to entrepreneurs, corporations and professional investors in consumer products, manufacturing, business services, technology, health care and resort & hospitality industries. By combining a proven process, industry & transactional expertise, and personalized service, Mirus has completed hundreds of transactions for both public and private companies. Our affiliate Mirus Securities, Inc. is a registered broker-dealer and FINRA member. For additional information, visit www.merger.com.

DISCLAIMER

While the Information is based on information that Mirus believes is reliable, Mirus makes no representation or warranty as to the accuracy or completeness of the Information (including without limitation the conclusions to be drawn therefrom), and each expressly disclaims liability for any representations, express or implied, contained in, or for any omissions from, the Information or any other written or oral communications transmitted to the recipient in the course of the recipient’s evaluation of the information. This is not an offer to sell or purchase securities of any sort – public, private or government. Mirus disclaims any liability for loss or damage which may be incurred by any recipient of Information.

Recent Comments